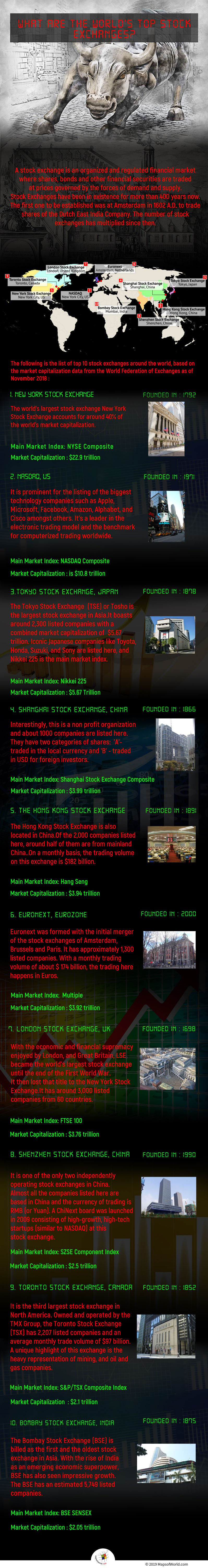

What are the World’s Top Stock Exchanges?

A stock exchange is an organized and regulated financial market where shares, bonds and other financial securities are traded at prices governed by the forces of demand and supply. Stock Exchanges have been in existence for more than 400 years now. The first one to be established was at Amsterdam in 1602 A.D. to trade shares of the Dutch East India Company. The number of stock exchanges has multiplied since then. The earlier stock exchanges were based on an outcry system on the trading floor, where brokers used verbal communication to find buyers and sellers on behalf of their clients. With advances in technology, this system gave way to the computer-based electronic trading which is largely prevalent now.

Stock Exchanges play an important role in the world economy and help raise funds for projects crucial for national and international economic development. The following is the list of top 10 stock exchanges around the world, based on the market capitalization data from the World Federation of Exchanges as of November 2018.

The Top 10 Stock Exchanges in the World are:

1. New York Stock Exchange

The world’s largest stock exchange was founded in 1792. It has a market capitalization of $22.9 trillion and has about 2,400 listed companies. Around 40% of the world’s market capitalization is accounted for by this stock exchange, and more than half the American population is believed to have invested in the stocks listed here. In 2018, it maintained its leadership position in Initial Public Offerings (IPOs) that raised more than $1 billion each, as well as in international listings of companies from countries as diverse as China, Brazil and the UK. NYSE Composite is the main index of the New York Stock Exchange.

2. NASDAQ, US

This stock exchange was founded in 1971 and is prominent for the listing of the biggest technology companies such as Apple, Microsoft, Facebook, Amazon, Alphabet, and Cisco amongst others. It’s a leader in the electronic trading model and the benchmark for computerized trading worldwide. The market capitalization of NASDAQ is $10.8 trillion and the average monthly trading is worth $1.26 trillion. NASDAQ Composite is the main index of this exchange.

3. Tokyo Stock Exchange, Japan

Founded in 1878, the Tokyo Stock Exchange (TSE) or Tosho is the largest stock exchange in Asia. Beginning as Tokyo Kabushiki Torihikijo, in 1943 it combined with 10 other stock exchanges to form the Japanese Stock Exchange. After World War II, the stock exchange was suspended for four years and resumed operations in 1949 as the Tokyo Stock Exchange. It boasts around 2,300 listed companies with a combined market capitalization of $5.67 trillion. Iconic Japanese companies like Toyota, Honda, Suzuki, and Sony are listed here, and Nikkei 225 is the main market index.

4. Shanghai Stock Exchange, China

Interestingly, this is a non profit organization and about 1000 companies are listed here. The origin of this stock exchange dates back to 1866. However, it was suspended in 1949 following the Chinese Revolution, when the Chinese Communist Party leader announced the creation of the People’s Republic of China. After a long hiatus, and following a period of economic reforms, in 1990 it was established again in its new modern avatar by the China Securities Regulatory Commission. They have two categories of shares: ‘A’- traded in the local currency and ‘B’ – traded in USD for foreign investors. It’s market capitalization is around $3.99 trillion. Shanghai Stock Exchange Composite Index is the main index of this stock exchange.

5. The Hong Kong Stock Exchange

The Hong Kong Stock Exchange is also located in China, and was formally established in 1891. With the rise of Hong Kong as a major financial center and commercial port as a colony of the British Empire, by the 1970s there were four stock exchanges in operation in the city, which led to demands for a unified stock exchange. Following 1987 Black Monday of global market crash, significant reforms were introduced over the next few years. In 1997, Hong Kong was transferred to China by the British. In 2017, electronic trading took over on this exchange, after closing its physical trading floor. Of the 2,000 companies listed here, around half of them are from mainland China. On a monthly basis, the trading volume on this exchange is $182 billion and the total market capitalization of the exchange is around $3.94 trillion. Hang Seng is the main index of this exchange.

6. Euronext, Eurozone

Following the establishment of European Union (EU) which sought to promote a single market for goods and services for its member states in Europe, Euronext was formed in the year 2000 with the initial merger of the stock exchanges of Amsterdam, Brussels and Paris. Headquartered in Amsterdam, the capital of the Netherlands, Euronext has now evolved into a pan-European stock exchange with a presence in France, Belgium, Ireland, and Portugal. It has approximately 1,300 listed companies with a combined market capitalization of $3.92 trillion. With a monthly trading volume of about $ 174 billion, the trading here happens in Euros. Stocks listed at Euronext trade in Euros.

7. London Stock Exchange, United Kingdom

The London Stock Exchange (LSE) has its origins in 1698, after the Parliament enacted an Act to regulate brokers operating loosely in the commodities market. Initially, it is believed to have started with brokers collecting in a coffee house where commodities were traded intermittently. Later, many brokers started operating in the streets and alleys of London. Responding to the increasing demand, the loose operation transformed into a ‘Subscription Room’. With the economic and financial supremacy enjoyed by London, and Great Britain, LSE became the world’s largest stock exchange until the end of the First World War. It then lost that title to the New York Stock Exchange. The current exchange was formed in 2007 following the merger of the LSE with Borsa Italia, which resulted in the formation of the London Stock Exchange Group. Its main index is FTSE 100, and with around 3,000 listed companies from 60 countries, it enjoys a combined market capitalization of $3.76 trillion.

8. Shenzhen Stock Exchange, China

It is one of the only two independently operating stock exchanges in China. Formally established in 1990, the Shenzhen Stock Exchange in the Guangdong province has major presence of state companies where the Chinese government holds controlling stake. Its market capitalization is $2.5 trillion as of November 2018. Almost all the companies listed here are based in China and the currency of trading is RMB (or Yuan). A ChiNext board was launched in 2009 consisting of high-growth, high-tech startups (similar to NASDAQ) at this stock exchange.

9. Toronto Stock Exchange, Canada

This stock exchange was founded in 1852. It is the third largest stock exchange in North America. Owned and operated by the TMX Group, the Toronto Stock Exchange (TSX) has 2,207 listed companies with a combined market capitalization of $2.1 trillion, and an average monthly trade volume of $97 billion. The TMX Group was in talks to merge with the London Stock Exchange in 2011 but it couldn’t get the approval of shareholders. Canada’s all ‘Big Five’ commercial banks are listed at the Toronto Stock Exchange. A unique highlight of this exchange is the heavy representation of mining, and oil and gas companies.

10. Bombay Stock Exchange, India

The Bombay Stock Exchange (BSE) is billed as the first and the oldest stock exchange in Asia, and was founded in 1875 by a successful local businessman of Mumbai. The initial gathering of brokers used to take place in the shade of trees, and it was much later that they found a permanent place on Dalal Street (literal translation means ‘middleman street’). With the rise of India as an emerging economic superpower, BSE has also seen impressive growth. As of November 2018, it had a market capitalization of $2.05 trillion. The BSE has an estimated 5,749 listed companies, and its main index is S&P Bombay Stock Exchange Sensitive Index, also known as the BSE Sensex.

Related Links:

- What are the Ten Best Police Forces in the World?

- What are the Top Ten Countries with most Internet Users?