Most Traded Currencies

The foreign exchange market, also known as the forex market, is the largest financial market in the world with an average daily trading volume of $6.6 trillion. This market allows for the exchange of currencies between countries, and as such, some currencies are more frequently traded than others.

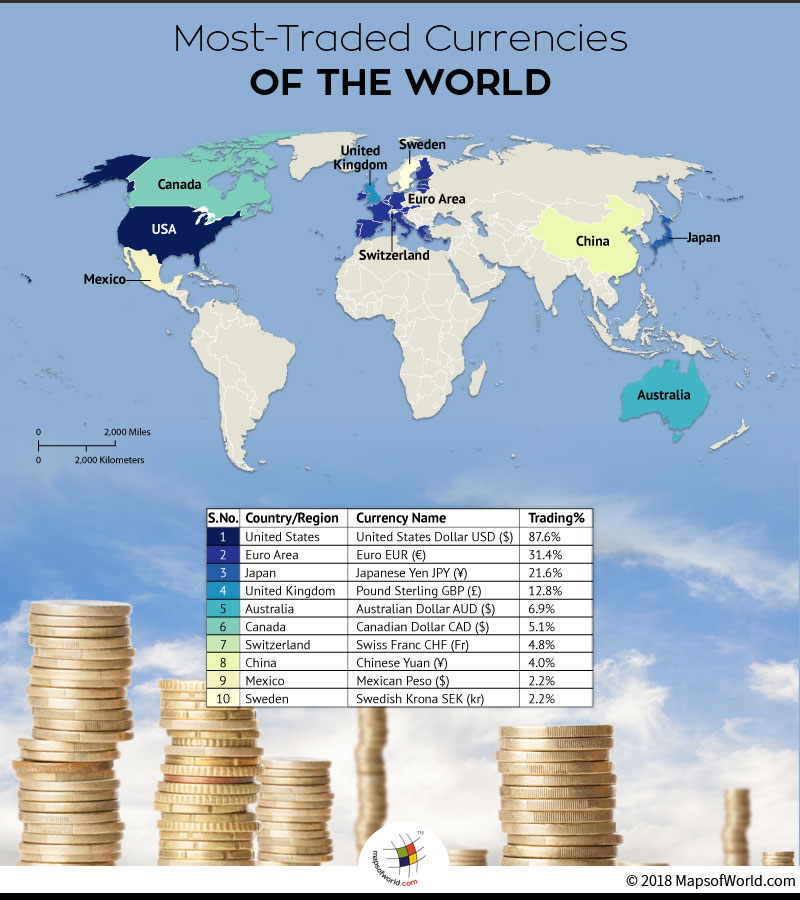

Let’s take a closer look at the top ten most traded currencies in the world:

Most Traded Currencies in the World |

|||||

| Country | Currency | ISO Code | Symbol | Average Daily Trading Volume (trillions of USD) | Percentage Share (2021) |

| USA | US Dollar | USD | $ | 4.9 | 88.3% |

| Eurozone | Euro | EUR | € | 1.8 | 32.4% |

| Japan | Japanese Yen | JPY | ¥ | 0.9 | 16.6% |

| United Kingdom | British Pound | GBP | £ | 0.7 | 13.0% |

| Australia | Australian Dollar | AUD | A$ | 0.4 | 7.2% |

| Switzerland | Swiss Franc | CHF | Fr | 0.3 | 5.2% |

| Canada | Canadian Dollar | CAD | C$ | 0.3 | 4.6% |

| China | Chinese Yuan | CNY | ¥ | 0.2 | 4.3% |

| Hong Kong | Hong Kong Dollar | HKD | HK$ | 0.1 | 1.9 |

| Sweden | Swedish Krona | SEK | kr | 0.1 | 1.8 |

Know more:

- List of World Currencies

- Countries Using Dollar as National Currency

- World Reserves of Foreign Exchange and Gold

- Richest Countries in the World

Related maps: